Litecoin price has spent almost ten days under the midway point of its current range. At the time of writing, LTC is taking a jab at a critical resistance level, trying to head higher.

A successful breach of the said supply barrier will likely trigger an upswing.

Litecoin price slid below the 50% Fibonacci retracement level at $171.27 on June 7 and has been trying to undo it. However, its efforts over the past ten days have gone to naught. At present, LTC is grappling with $171.27; a decisive 4-hour candlestick close above it will signal the start of an upswing.

In such a case, Litecoin price could rally 12% to tag the 70.5% Fibonacci retracement level at $193.34. In some cases, the altcoin might retest the next barrier at $202.50.

However, if LTC manages to close above $202.50, it might even reclaim the range high at $225.11.

LTC/USDT 4-hour chart

Supporting this upswing is the 365-day Market Value to Realized Value (MVRV) model in the opportunity zone. This fundamental index is used to measure the average profit/loss of investors that purchased LLTC over the past year.

A negative value represents that the short-term traders are selling their LTC holdings, allowing the long-term holders to accumulate.

The last time the 365-day MVRV model dipped to -14.25% was in mid-September, and Litecoin price rose roughly 200% in following four months. Therefore, if something similar were to happen, LTC could be due for a massive upswing.

LTC 365-day MVRV chart

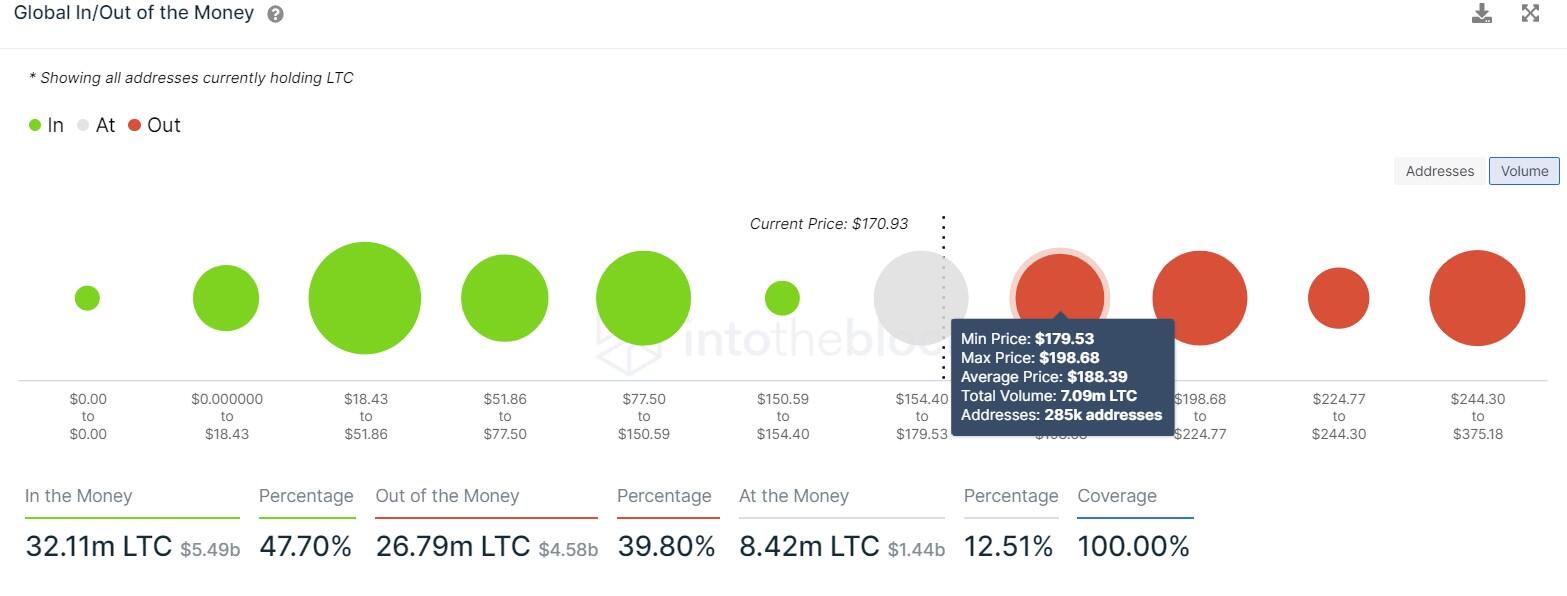

On the other hand, IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that underwater investors are stacked, large in number and present up to $300.

285,000 addresses that purchased 7.09 million LTC at an average price of $188.39 are “Out of the Money.”

Hence, a short-term surge in buying pressure will likely face selling pressure from these holders who might want to break even.

To make matters worse, GIOM shows that the immediate support level at $152.49 harbors only 16,300 addresses that purchased nearly 185,000 LTC. Therefore, a downswing might be prominent, should it arrive.

LTC GIOM chart

Therefore, investors need to exercise caution and wait for a decisive close above the $171.27. If Litecoin price creates a lower low below the recent swing low at $154.10 set up on June 12, it will invalidate the bullish thesis.

In such a case, LTC might revisit the range low at $117.43.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

0 Comments